THIS was the theme of this year’s project at Columbia University. The project was deliberately less structured that projects from previous years. A small group of bright students worked the project from mid-May, and on August 6, they submitted their final report.

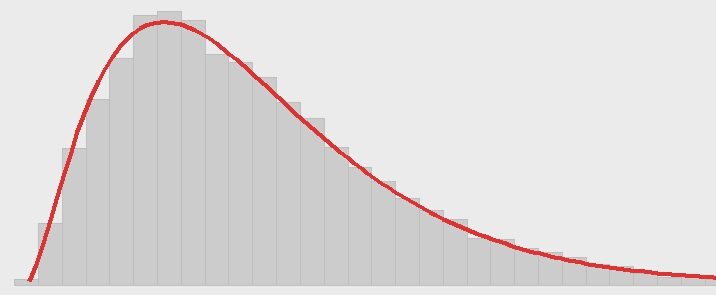

Many Machine Learning applications in insurance deal with customer segmentation, fraud detection, and pricing. Our project used a K-Means clustering algorithm to partition claim records into four clusters, which were considered “risk clusters.” Subsequently, these risk clusters were matched to a probability distribution that has been proved, with selected parameters, to fit property loss experience well.

In my view, the most challenging part of the project was to create a persuasive presentation that explained the concepts underlying the project.